You might have heard about how low Denmark’s unemployment rate is, and you’ve probably heard about the country’s fantastic unemployment benefits. Unemployment funds save people time, energy, and effort, especially so with the most recent pandemic. They’re not like other social benefits; to receive unemployment insurance, you have to proactively seek it out before you find yourself unemployed. There can be a lot of options, rules, and requirements, and it can be difficult to follow, but we’re here to help answer all your questions.

So let’s start from the beginning; what exactly is an unemployment fund?

An unemployment fund is a type of private insurance that you pay a monthly fee towards in order to have unemployment benefits and a reasonable income if you experience a job loss or can’t find a job after graduation. These funds are often referred to as “a-kasser”, in Danish. All Danish unemployment funds are owned by private organisations, and there are a total of 23 unemployment insurance funds that operate in Denmark.

See the list of all of the unemployment funds/a-kasser in Denmark below.

| Unemployment fund | Open to | Price per month | Sign up online |

| Det Faglige Hus A-kasse | Anyone | DKK 486 |

Sign up here |

| ase A-kasse | Anyone |

DKK 514 |

Sign up here |

| FTF A-kasse | Anyone | DKK 472 |

Sign up here |

| Min A-kasse | Anyone |

DKK 490 |

Sign up here |

| 3F A-kasse | Some professions | DKK 524 |

Sign up here |

| Akademikernes A-kasse | Anyone |

DKK 467 |

Sign up here |

| Business Danmark A-kasse | Sales and marketing | DKK 490 |

Sign up here |

| Lederne A-kasse | Managers | DKK 480 |

Sign up here |

| Magistrenes A-kasse | Anyone |

DKK 511 |

Sign up here |

| DSA | Some professions | DKK 451 | Sign up here |

| A-JKS A-Kasse | Journalist | DKK 468 | Sign up here |

| BUPL A-Kasse | One profession | DKK 504 | Sign up here |

| SL A-Kasse | One profession | DKK 473 | Sign up here |

| Lærernes A-kasse | One profession | DKK 475 | Sign up here |

| TL A-kasse | Some professions | DKK 516 | Sign up here |

| HK A-kasse | Some professions | DKK 517 | Sign up here |

| FOA A-kasse | Some professions | DKK 519 | Sign up here |

| Din Faglige A-kasse | Some professions | DKK 521 | Sign up here |

| Dansk Metal A-kasse | Some professions | DKK 522 | Sign up here |

| NFF A-kasse | Some professions | DKK 527 | Sign up here |

What is the cheapest Unemployment fund in Denmark?

At the moment the cheapest unemployment fund in Denmark is DSA, which have a monthly fee of DKK 451. Note that 'DSA' only offers memberships to some professions. The cheapest unemployment fund who accepts all proffesions is 'Akademikernes A-kasse', whose monthly fee is DKK 467.

What are the benefits of having an a-kasse in Denmark?

Being a foreigner, it can be difficult to navigate the labor market. When you’re a member of an unemployment fund/a-kasse in Denmark, they are available to guide you with requirements, what you are entitled to, and how to collect your claims on your unemployment insurance.

There are so many benefits that can come from owning unemployment insurance. Here are a few:

· Financial security

· Peace of mind

· Personal advice on career choices, social events and courses

· Available for recently graduated students

· Often connected to and work with unions

What’s required from me to get unemployment insurance?

There’s not much required of you to get unemployment insurance. You can sign up if:

What is the difference between full-time and part-time unemployment insurance?

If you want full-time insurance, you have to work more than 30 hours a week on average and be able to apply for full-time work. When you are full-time insured, your monthly premium will be higher, but consequently, so will the payout.

If you want part-time insurance, you have to work 30 hours a week or less, and you will only have to apply for part-time jobs (up to 30 hours a week.)

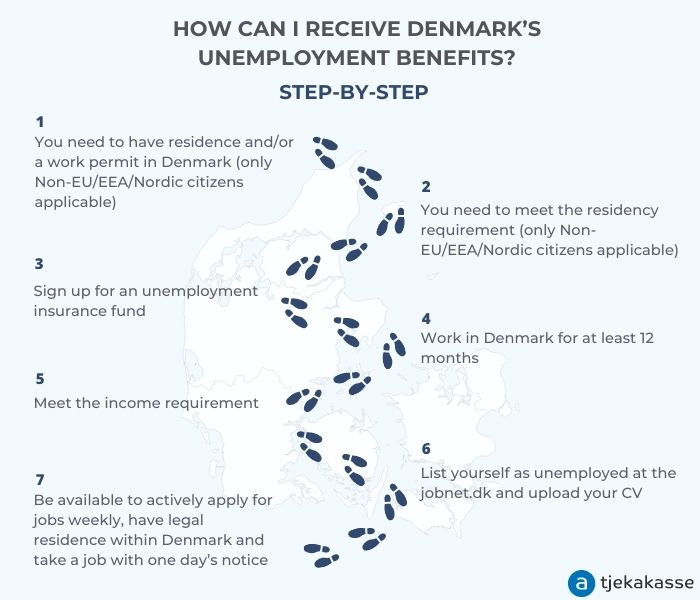

How can I receive Denmark’s unemployment benefits?

Not just anyone can claim unemployment benefit; you need to make sure you meet all the requirements before you can collect.

To apply for an unemployment insurance fund, you have to meet certain income requirements before collecting. Those vary if you have full-time or part-time insurance.

For full-time, you need to have earned a gross income of at least DKK 246.924 over the last 3 years. For part-time, the gross income is DKK 164.616 over the last 3 years. Despite what your monthly income is, you can count a maximum of DDK 20.577 per month. If you earn less, it will take more time than 1 year before you are eligible to collect. You have to meet the minimum income requirement and the minimum 1-year membership requirement.

What are Denmark’s unemployment Benefits like for 2022?

The amount that you’ll receive depends on quite a few things; whether you are part-time or full-time insured, what job you have, whether you have just graduated, with or without children, whether or not you have reached the age of 25, if you work for a company or are self-employed, and what A-kasse you belong to. Right now, you can receive a maximum of DKK 19.351 per month if you are full-time insured and DKK 12.901 per month if you are part-time insured.

You are also only entitled to unemployment benefits for up to 2 years, within a 3-year period calculated by working hours (3.848 hours full-time and 3.120 hours part-time). It’s also possible to extend the 3 years if you were on maternity leave or were grievously ill.

Usually, unemployment insurance funds partner with unions, so you might be asked to sign up with a union by your A-kasse. Unions will help you legally when your working rights have been infringed upon. For example, a union could help you if you’ve been illegally terminated, not given proper working conditions, refused holiday time or pay, etc.

They can also help you with negotiations for your work contracts. Regardless of whether you decide to join a union with your unemployment fund or not, it’s important to know your rights. You are free to choose whether or not you want to be a part of a union. If you end up deciding that you don’t want to join a union with your A-kasse, it will not affect your benefits.

Unemployment rate Denmark 2022

That makes the unemployment rate 2,7% for Juli 2022 which is 0,1 percentage points more than the month before.

The increasing employment rate is due to the immigration of Ukranian refugees who are considered ready to enter a full-time position.

What is the price for an unemployment insurance fund in Denmark?

The monthly fee for being af member of an unemployment insurance fund in Denmark is between DKK 451-560. Most Unemployment insurance funds have free memberships for students.

What are the benefits of an employment insurance fund?

- Financial security

- Peace of mind

- Personal advice on career choices, social events and courses

- Available for recently graduated students

- Often connected to and work with unions

Can everybody receive unemployment benefits in Denmark?

To receive unemployment benefits in Denmark it requires:

- Resident or a work permit in Denmark

- You need to meet the recidency requirements (only Non-EU/ EAA/ Nordic citizen applicable)

- Sign up for an unemployment insurance fund

- Have worked in Denmark for at least 12 months

- List yourself as as unemployed in www.jobnet.dk and add your CV

- Be available to actively apply for jobs weekly, have legal residence in Denmark and be able to take a job with one day's notice